Why is money developed?

Before the creation of money, people around the world processed their trading and transactions by barter. In other words, when trading for a bag of rice, people will use something equal in value like a bag of corn as a temporary currency.

Thus, making this early form of transaction inefficient, preventing free and active transactions to be made between people. Barter requires people to go out and look for the products in demand and the potential trader by themselves – things that are handled by agencies and marketing brands today.

For instance, people who have wheat and want to have meat, then they would have to go out looking for someone who has meat and desires wheat. Another drawback is that they cannot and don’t have any specific measurements on making sure that much of wheat value equals that much value of meat.

Therefore, causing confusion and conflicts between people and countries, thus, the “medium of exchange” or money is developed that now grows into four different types of money. Facilitating financial transactions such as instant cash credit cards in Malaysia.

Types of money

Commodity

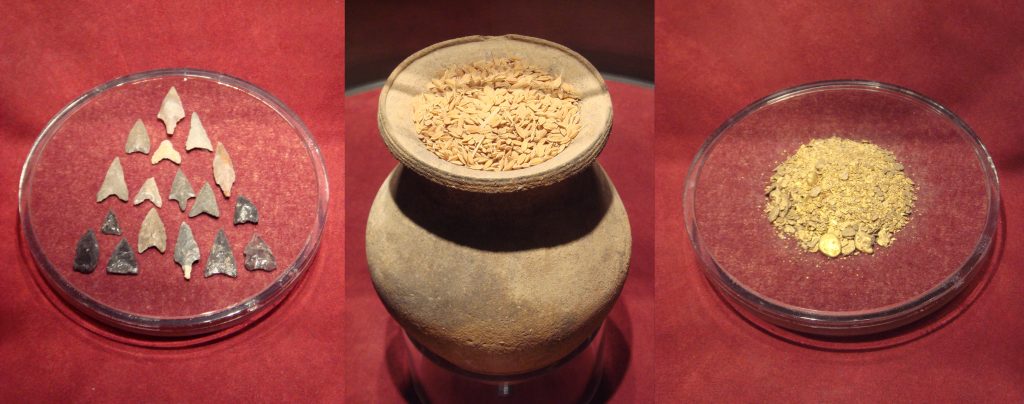

This is the first and the simplest type of money used in barter as valuable resources meet the functions of money. It could be understood as a type of good that acts as currency, it could be seen in the popular public symbol of using clam shells as money, or when American colonists in the 17th and early 18th centuries used beaver pelts and dried corn as transaction currencies.

Commodity money shared certain characteristics:

- Widely desired,thus, more valuable

- Durable, portable, and easy to store as they work as coins that are made from several materials: gold, feather, shell, rock, bronze, silver, iron…

Additionally due to commodity money diversification in crafting materials and the regional unification of their value. Commodity money materials and shapes vary based on the region using it.

Fiat

Fiat is the second type of money that does not require its users to have a physical commodity backup. The value of fiat money is set up by supply and demand, and people’s faith in its value. Money was born due to the scarcity of gold or other types of money-making material during booming economic activities.

Since it has no physical value and its value is determined by people’s perceptions, its value is commonly set by the region’s government which could vary depending on the needs. Creating the foundation for modern money as they are now determined by the market forces of demand and supply

A typical example of fiat money is paper money, a piece of paper has no value until the government imposes the values on it.

Fiduciary

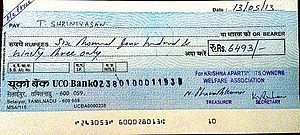

This is more like a modern-born type of money that meets the monetary fiduciary of today’s system. Fiduciary money allows people to pay with different types of money and let them temporarily transfer or promise the transactions to another person. An example of this could be banknotes or cheques.

Commercial

Commercial money or demand deposits that are claimed against financial institutions could be used to pay for goods and services. This modern type of money comes in the form of a bank account from which its funds/contents could be withdrawn at any time by cheques or at ATMs without announcing the financial institution.